Selling puts is a great way to generate income or acquire shares of stock. Rather than buying on the open market, you can potentially purchase a stock below its current market price and earn a bit of income along the way. But while the strategy may appear simple, it’s easy to make costly mistakes if you don’t take the time to understand options and plan a strategy. In this article, you’ll learn about some of the most common mistakes when selling put options and tips that you can use to avoid them.

Benefits of Selling Puts

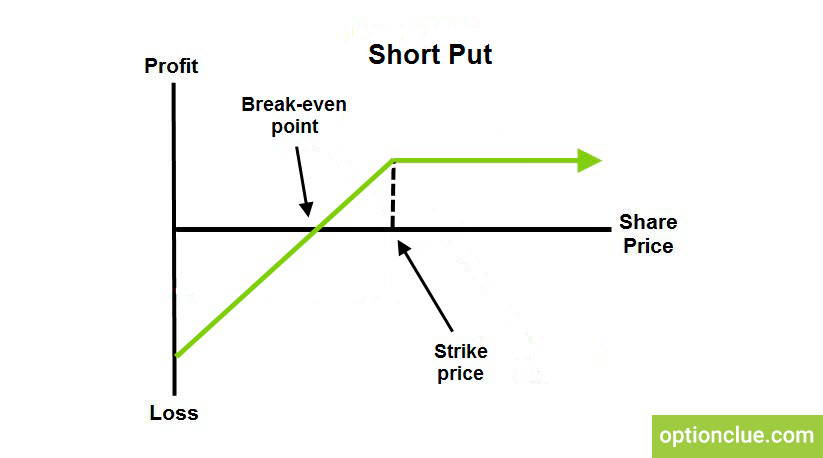

A put option is a financial contract giving the holder the right, but no obligation, to sell a specified amount of an underlying stock at a predetermined price within a specific timeframe. The seller of the put option is obligated to buy the underlying asset at the strike price if the holder chooses to exercise the option.

A diagram of a put option showing the profit/loss potential. Source: OptionClue

There are several reasons you might sell put options:

- Income Generation – Most people sell put options to generate income through the premiums you collect when you sell the option.

- Stock Acquisition – If you’re bullish on a stock but think it’s currently overpriced, you can sell a put option at a strike price where you’d be comfortable owning the stock. If the stock is exercised, you’ll acquire the shares at a cost basis reduced by the premium.

- Neutral Outlook – If you believe the underlying stock price won’t move much, selling put options can help you generate income without taking a strong position in the stock.

- Hedging Strategies – You might sell a put option as part of a hedging strategy. For instance, you might sell a put option on a stock you already own, so you can offset a slight dip in the stock price with the premium income.

You can also use put options as part of a larger strategy. For example, the Option Wheel Strategy involves selling a put option on a stock you wouldn’t mind owning, eventually acquiring the stock, and then writing call options until an exercise occurs. In essence, you can earn income above and beyond dividends by buying and selling stocks you don’t mind owning.

#1: Lack of Understanding

Selling put options requires a solid understanding of options, volatility, and the underlying asset. If you don’t have a firm grasp on the mechanics and risks associated with selling put options, you’re at a higher risk of making costly mistakes. So, it’s worth taking the time to understand how options work and the factors influencing their risk and reward.

Most people understand that selling a put option gives someone else the right to sell their stock to you. In other words, you’re obligated to purchase someone’s stock at a set price over a specified timeframe. But if you don’t understand concepts like intrinsic and time value, it’s impossible to know whether you’re selling an option at a good price.

Moreover, if you don’t understand open interest, you could also find yourself in a situation where wide bid-ask spreads make it challenging to exit a position at an attractive price. And without understanding margin requirements, you could receive an unexpected margin call, forcing you to deposit additional funds or liquidate a position at an inopportune time.

#2. Poor Risk Management

Selling put options is a relatively low-risk strategy. For example, if you sell one put option with a strike price of $10, you could lose a maximum of $1,000 (100 shares x $10) if the stock goes to zero. And unlike a naked call, where you could experience unlimited losses, naked put options still have a downside capped at the product of the number of shares and the strike price.

However, people underestimate the risk of selling a put option. If you’re using the strategy to generate an income, it’s easy for the modest income you receive to turn into a loss if the stock quickly falls. And worse, if the stock quickly moves lower, you might not have time to sell the stock at an attractive price to limit your downside risk.

There are two ways to manage position sizes:

- Risk as a percentage of your account value.

- Consistent dollar values per position.

Effective risk management involves choosing fundamentally and technically sound stocks, as well as diversifying across different sectors. That way, you don’t necessarily experience heavy losses if the entire tech sector declines or the price of oil falls. In addition, if you’re using margin, you should be careful to avoid over-leveraging (leading to high margin requirements).

#3. Choosing the Wrong Options

Choosing the right strike price is critical to successfully writing put options. A strike that’s too close to the current price has a high risk of being exercised, while a strike price far out of the money may not offer enough potential income. You need to find the right balance between these two goals to ensure that you achieve an optimal risk/reward ratio.

Some questions to ask include:

- How long do you think the stock will remain low?

- Are there any upcoming events that could send it higher?

- Is there a chance that the stock could move sharply lower?

The timing of a sale also has a tremendous impact on the success of selling put options. If you sell a put option during a period of low volatility, you will receive less premium income than if you sell during a period of high volatility. So, it’s important to keep an eye on historic and implied volatility to ensure you pull the trigger at an opportune time.

The best strike price distance and time frame depend on your market outlook, risk tolerance, and investment objectives. But if you’re seeking income (and not necessarily stock ownership), you may want to consider writing a put option that’s slightly out-of-the-money while avoiding earnings or any other volatility-inducing events.

Finally, as an option seller, you benefit most from time decay This means short-term options make the most sense as the pace of time decay increases as expiration approaches. Repeated sales of short-term options should result in more income than one sale of longer-term options all else being equal. This also means more time and attention must be paid to the management of your portfolio.

#4. Succumbing to Emotion

Emotions can play a disruptive role in trading, and writing put options is no exception. The emotional highs of a successful trade can lead to overconfidence, leading to riskier positions without adequate preparation or understanding of the potential downsides. Conversely, a trade gone wrong can lead to a knee-jerk reaction to sell without looking at the alternatives.

You can avoid succumbing to these kinds of emotional mistakes by creating a plan. You should have a plan for what to do if a trade goes against you. Will you buy the option back? Roll it? Let it be exercised and buy the stock? By planning for different outcomes, you don’t have to rely on an emotionally driven in-the-moment decision.

Stock prices can move at a surprising, unpredictable pace. You can have many successful put sales before a significant drop in a stock’s price erases a lot of gains. New put sellers can be very frustrated the first time they are forced to buy shares at a price a lot higher than the stock’s current market price.

If you need help creating a plan, the Snider Investment Method provides a done-for-you strategy to help you navigate the market’s complexities. In the free e-course, you can learn how to select the right stocks, how various types of options work, and how to manage risk to generate income in your portfolio by selling put and call options.

#5. Mistakes with Execution

Most people execute trades without an afterthought, but doing so can be risky. For example, using market orders can result in poor execution prices, especially in illiquid options markets. Market orders also increase the risk of slippage, where the price of the option can change significantly over a short period of time, leading to unwelcome surprises.

You should also be sure to factor trading costs and taxes into your profit and loss calculations. Commissions and fees can quickly add up, particularly if you’re frequently entering and exiting positions. And a failure to account for the tax implications of different trades – especially because they’re “short-term” capital gains, can lead to issues come April.

The Bottom Line

Selling put options can help generate income and/or help you acquire stock at an attractive price, but there are several caveats to keep in mind. By understanding some of the most common mistakes, you can avoid costly errors and ensure you’re meeting your financial goals.

If you’re looking for a systematic way to generate income with options, the Snider Investment Method can help you streamline your approach and reach your financial goals.

Sign up for our free e-course today to get started!