Where do less-seasoned investors go to get the information they need about the stock market? What are the best investing tools available to new investors?

Whether you’re completely new to investing or you’re simply switching strategies and looking for some guidance, every investor needs help tracking the market and making good financial decisions.

This is especially true if you’re managing your own portfolio or trying to take more control over your financial planning. It’s important to know which resources are available to you, which will help, and where you can go if you have immediate questions.

With that in mind, here are a few perfect resources for investors who need a little support.

Investopedia

Chances are good if you’ve searched any sort of investment advice on the Internet, you’ve found an Investopedia article.

Investopedia, like Wikipedia and other digital encyclopedias, is a tool designed to give you all the background information you need about investing, from complex concepts to jargon and buzzwords.

They’re one of the biggest names out there in terms of finding investment education, which makes them a great resource for any investor, professional or otherwise.

They have several unique offerings especially for new investors, however, including investment guides like Stock Basics. They also feature current financial news, trending articles, and other resources for staying up-to-date on the investment world.

One of their biggest boons is a stock market simulator that can help you see how your chosen stocks will play out. You start with $100,000 in virtual cash and compete with thousands of Investopedia traders to sharpen your trading know-how.

Key features:

- Searchable dictionary of financial terms

- Investment simulator

- Network of advisors for investment FAQs

Investor.gov

Investor.gov is another online resource dedicated to helping you invest wisely and avoid fraud. They work with The Office of Investor Education to provide information to better educate investors using everything from print publications to seminars and training programs.

The benefit of this site is that they often partner with federal agencies, giving you first-hand advice about how to protect your assets and secure your investments. They have a resource forum dedicated to answering questions about fraud or other money-related concerns as well.

In addition to articles, guides, and resources, they also offer free financial planning tools that will help you calculate things like 401(k) Required Minimum Distributions, compound interests, social security retirement funds. They even have a mutual fund analyzer so you can see how fees and expenses impact your overall investment value.

Key features:

- Introduction to Investing resource hub

- Investment protection forums and fraud prevention advice

- Free financial calculators for investors

Morningstar

Morningstar is a membership-based site designed to help people plan, save, and invest to reach their financial goals. They not only provide tools and advice for investors of all kinds, they also offer independent research to help educate investors on market trends.

According to their website, they were founded by 27-year-old stock analyst Joe Mansueto, who “thought it was unfair that people didn’t have access to the same information as financial professionals.” He created Morningstar as a way to deliver investment research to everyone.

Free members can help themselves to continually updated information on investments from mutual funds to ETFs, as well as broad spectrum economic and market commentary.

Premium membership offers a bit more, like mutual fund screeners, actionable reports, and an X-Ray tool that ensures you don’t over-allocate funds.

They also have a fund ratings guide, which is an independent ratings tool based on risk and historical returns of mutual funds.

Key features:

- Free and paid memberships for investors

- Screening tools, calculators, and mobile apps

- Portfolio analysis and access to independent research

The Motley Fool

The Motley Fool was once considered a “dot-com boom” business, but is now a full-fledged multimedia financial-services company that provides financial solutions for investors through various stock, investing, and personal finance services.

They use a variety of witty and intelligent insights into today’s biggest financial topics to educate investors, in addition to a variety of guides like How to Invest.

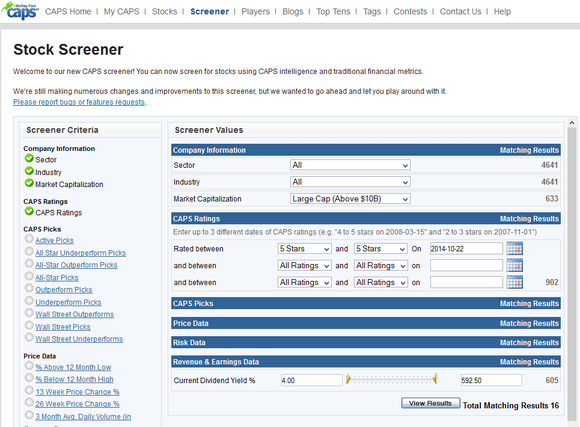

One of the biggest draws is the Motley Fool’s CAPS Community, where members can research, rank, and share stocks with each other.

This can be a great resource for newer investors who are unsure of which stocks to pick or how to navigate the market. Their articles are often written in an easy-to-read, refreshing tone that won’t overwhelm with overly technical information.

Key features:

- Interesting and educational articles about investing

- Guides and toolkits for new investors

- CAPS community for stock advice

Khan Academy

While not strictly an investment or financial tool, Khan Academy still offers world-class financial education for free.

Founder Salman Khan is a former hedge fund manager who gave up navigating the market for himself to teach others how to do it. He has three degrees from MIT, as well as one from Harvard Business School, which he employs to help regular people make sense of complex financial concepts.

Khan Academy excels at presenting dry material in an engaging way, using digital whiteboards to teach financial principles to both new and seasoned investors.

They have courses on everything from micro and macroeconomics to finance and capital markets. Here you can learn about the basics of stocks and bonds, investment vehicles, options, swaps, futures and more.

Key features:

- Free courses on the basics of investing

- Exercises and test for knowledge retention

- Whiteboard lessons for easy learning

Bonus: Snider Advisors Educational Resources

We’d be remiss not to mention that we also offer several free courses, including Stock Selection 101, Option Investing 101, and Climbing to Profits. We believe that an educated investor is a successful investor.

Final Thoughts

Whether you’re new to investing, wanting stock advice, or you’re simply looking to brush up on the latest trends, there are tools available to you to help guide you through the process. There are a ton of great investing tools available to non-professional investors.

When looking for the optimal tool, consider your end goals. What do you need to learn? How quickly do you need to learn it? And how much financial commitment are you willing to invest into your education?

If you can determine where you are in the learning process, you can quickly and easily access the resources you need to master investing once and for all.