Bonds were a relatively uneventful asset class until the 2008 financial crisis when they quickly became a top performer. Over the course of the crisis, highly rated bonds posted a modest six percent return when stocks lost nearly 40 percent of their value. Investing in bonds could have saved a portfolio from catastrophe!

In this article, we will take a look at when to invest in bonds, how to invest in bonds, and some alternatives that you may want to consider for your portfolio.

When to Invest in Bonds

A bond’s yield represents the discount rate of its remaining cash flows, which means the bond’s price reflects the value of the remaining yield. The price and yield have an inverse relationship for this reason. In addition to the discount rate, bonds are influenced by the term (e.g., long- versus short-term) and other attributes (e.g., callable versus non-callable).

There are also several external factors that influence bond prices:

- Interest Rates: Interest rates directly affect the discount rate. If interest rates rise, the bond’s yield rises and the bond’s price falls. It’s worth noting that bonds with a longer term are more sensitive to these changes since there’s more future cash flow to discount compared to shorter term bonds.

- Credit Ratings: Credit risk influences a bond’s price and yield in the form of a risk premium. The greater the risk of default, the higher the yield needs to be for bondholders to be compensated for that risk. These credit ratings are usually issued by agencies like Standard & Poor’s.

Like trying to predict economic cycles, finding the perfect time to invest in bonds can be difficult. An investor might purchase a bond for various reasons. First, you might expect interest rates to decline and want to capture the increase in the bond price. An income investor may purchase a bond for its interest payments and may be less concerned with the actual price of the bond. Some bond investors may invest to profit off credit rating improvements. If a company’s credit quality improves, their bond price should also appreciate.

There are a few reasons that you might consider moving into bonds at this time:

- Interest rates are likely to begin falling to stimulate growth as the economy slows from its cyclical high.

- Stocks tend to underperform during these times, which makes bonds a compelling asset allocation choice.

- Most investors are looking to de-risk their portfolios at this time and bonds provide greater protection than stocks.

How to Invest in Bonds

A growing body of research suggests that trying to time the market can diminish returns.

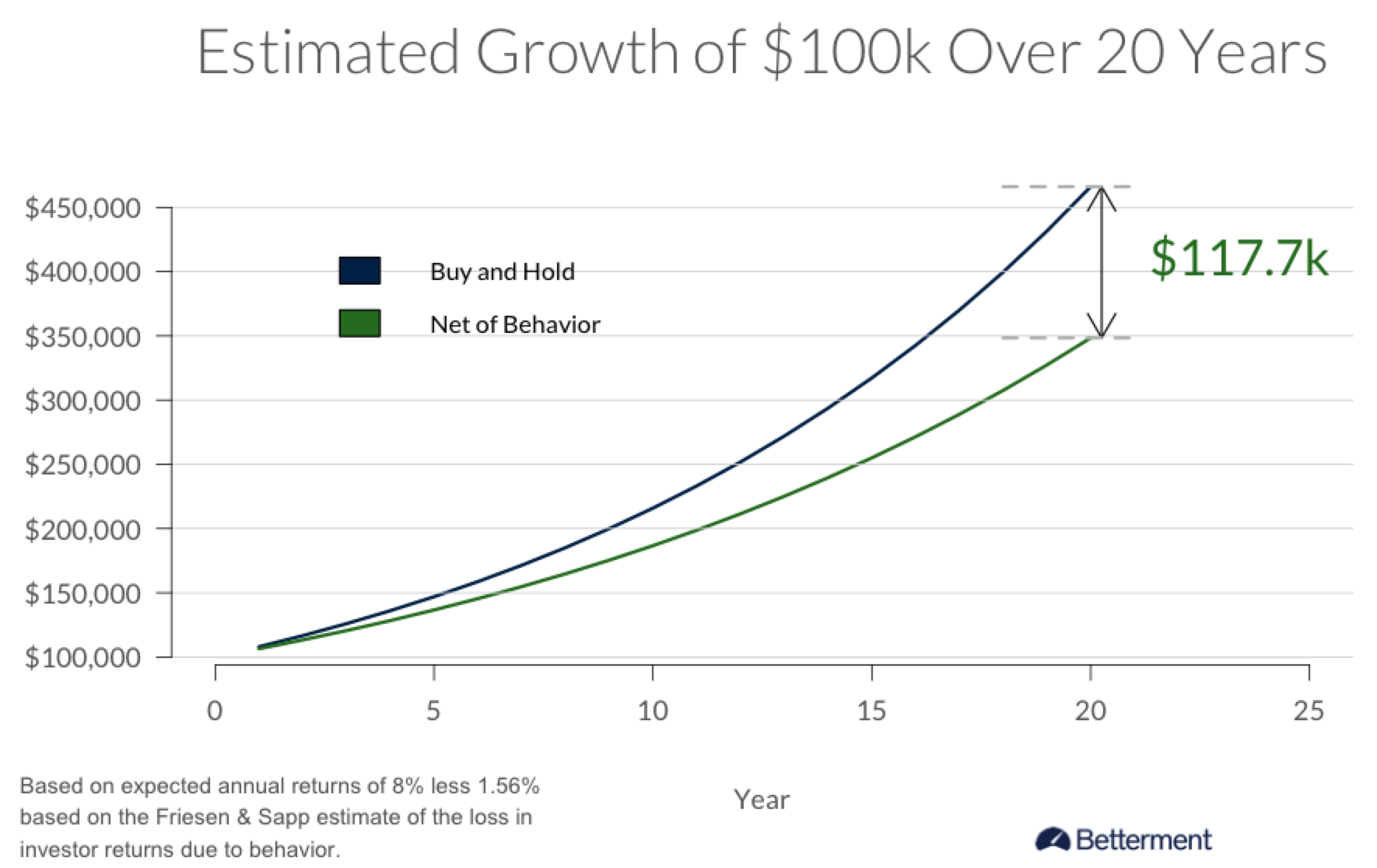

Betterment estimates that market timing and active trading cost investors up to 6.5 percent per year. Over a 20-year period, these poor decisions could cost an investor with an initial investment of $100,000 more than $117,000 in lost profits compared to a buy-and-hold investor.

Opportunity Cost of Market Timing – Source: Betterment

It’s better to take an asset allocation approach. While stocks tend to outperform bonds over the long-term, most financial advisors recommend incorporating bonds into a portfolio to diversify risk and generate returns. You should incorporate bonds based on asset allocations rather than timing the market.

There are many different ways to build bond exposure into your portfolio, including individual bonds and bond funds.

Buying and managing individual bonds can be a difficult and time-consuming process since the market is less liquid and more opaque than the equity market. However, there are some benefits for high net worth individuals that can take advantage of the tax benefits associated with municipal bonds, for example.

Most investors are better off purchasing bond funds, which provide diversified exposure for a small management fee. These funds tend to provide a wide range of bond types (e.g., government, corporate or high-yield) with various maturities to diversify interest rate and credit rating risk factors.

You may also want to consider purchasing different bond funds to further diversify a portfolio. For example, emerging market or international bond funds often provide higher yields given their greater credit risk and don’t necessarily react to changes in U.S. interest rates since they are not based in the U.S.

Alternatives to Bonds

Bonds are a great tool for diversification. However, the old belief that they are the best investment for income generation may not longer be true. There are many different alternatives to bonds depending on your investment objectives. By using stock options, you can achieve many of these goals without trying to time the market.

Investors looking to generate a steady income during retirement may want to consider writing covered calls. By writing a call option against an existing stock position, you can generate a regular income each month while still owning a portfolio of high-quality stocks and remaining in the market.

The Snider Method is designed to help investors learn how to create and manage covered call positions to maximize income and minimize risk. In addition, we offer a managed portfolio option for those looking to take a hands-off approach. Sign up for our free course to get started today!

Investors looking to de-risk their portfolios may want to consider hedging their portfolios with protective puts. By purchasing the right to sell, you can effectively create a price floor for your stock holdings without selling anything.

These strategies involve the ongoing management of option positions. Profits on option trades will also generate short-term capital gains, so it is important to consider your tax situation. Of course, this won’t matter in retirement accounts where you don’t track investment gains and losses. These days, it is very easy to use popular option strategies, like covered calls and cash secured puts, in retirement accounts.

The Bottom Line

Bonds are an important asset class for investors that rely on an income or investors that are looking to lower their risk. The best time to own bonds is at the top of an economic cycle when interest rates are likely to move lower, although actively timing the market has its drawbacks.

Investors may want to consider stock options as an alternative to bonds for income purposes. Using options, you can lower the risk of your stock portfolio and boost income. Predicting future interest rates is nearly impossible, but if rates continue to rise like they have recently, bonds will suffer.

Sign up for our free course to learn more about how The Snider Method can help you generate an income with options.