What do Josh Hamilton, Notre Dame, Peyton Manning, the L.A. Lakers, Tiger Woods and countless others have in common? The Sports Illustrated jinx – a legend that holds that very shortly after an athlete or team appears on the cover of Sports Illustrated, they will fall victim to profoundly bad luck.

Proof of the Jinx?

Need some proof of the legend? Consider this – in 1974, six days after Evel Knievel graced the Sports Illustrated cover, he missed a canyon jump and was forced to parachute 600 feet down. Many believe this event was the catalyst that led to the end of his career.

In 2002, Michael Jordan appeared on the cover. The next day, his wife filed for divorce. That same year, Sports Illustrated performed an extensive investigation to see if there was any truth to the jinx. They found that of the 2,456 covers published between 1954 and 2002, there were 913 cases of the jinx, or as they stated, “a demonstrable misfortune or decline in performance following a cover appearance roughly 37.2 percent of the time.”

Are There Investment Jinxes?

So how does this relate to investing? Have you ever thought about what happens to a mutual fund after it appears on Money magazine? Or receives a 5-star rating from Morningstar? Unfortunately, it’s typically not so different than the Sports Illustrated jinx.

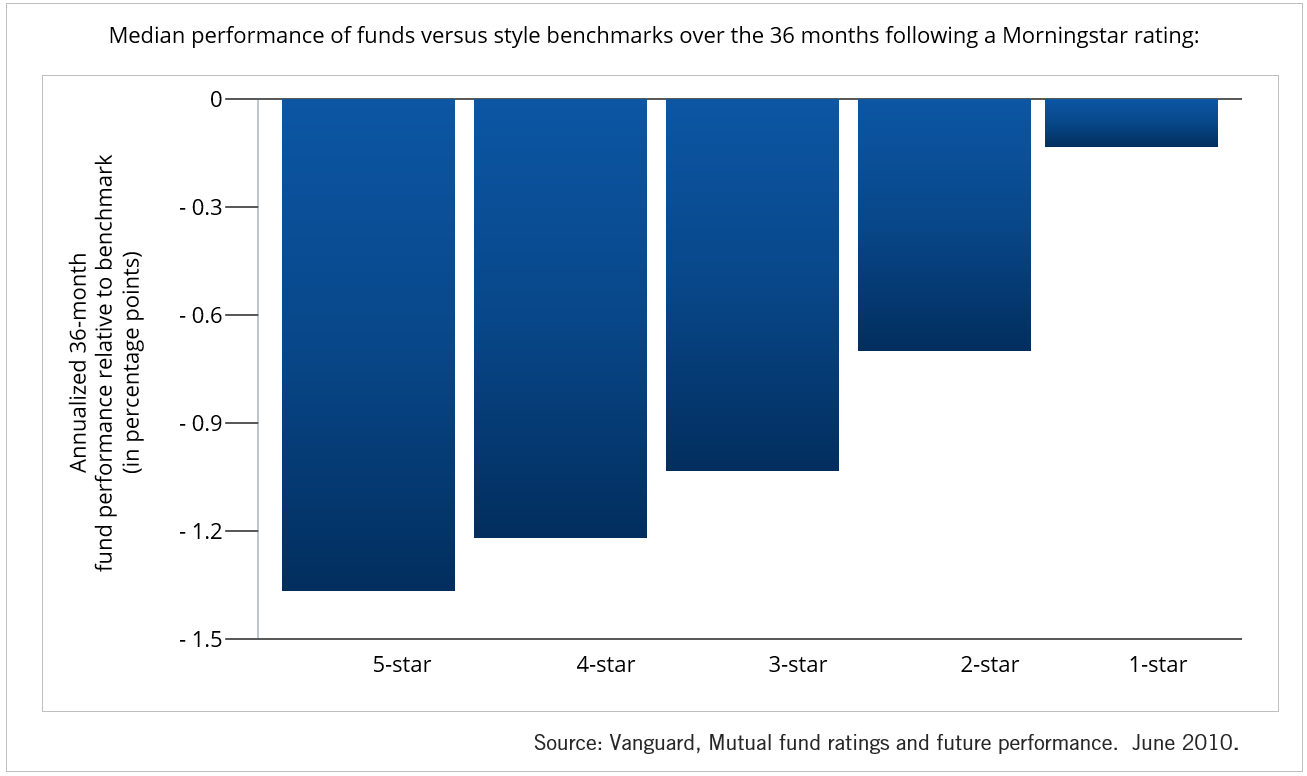

In a nutshell, Morningstar rates mutual funds from one to five stars, with five being the best, based on how well they’ve performed in comparison to similar funds over a 5 year window. In the table below, you can see the median performance of funds compared to relevant benchmarks in the 3 year window following their Morningstar rating. While none of the funds fared particularly well, the 5-stars really fell behind.

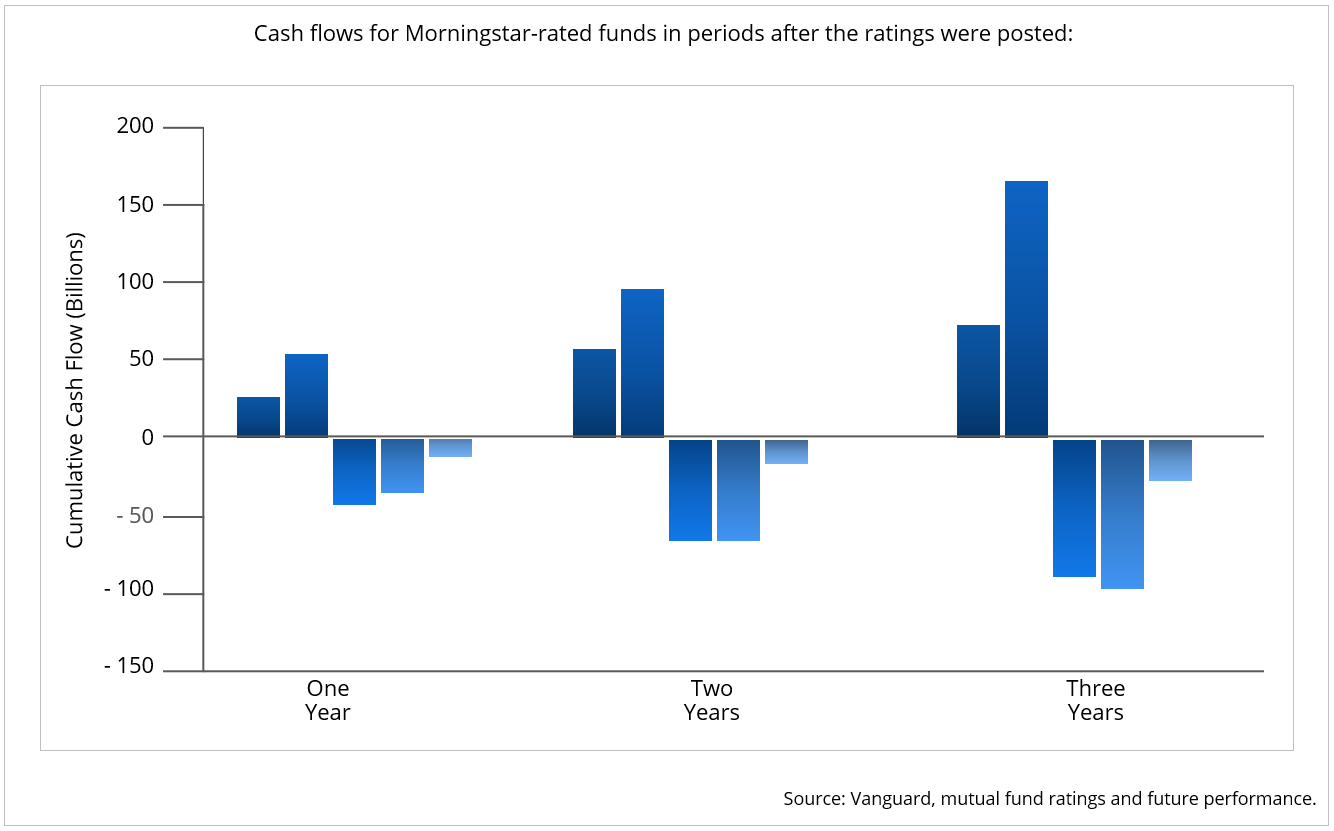

Yet while the funds were experiencing this performance, do you know what investors were doing? They were taking their money out of the 1, 2, and 3 star funds and pouring it into the 4 and 5 star funds.

Performance Chasing

There’s a name for this behavior. It’s called performance chasing and it is never a good idea.

Ultimately, these investors were taking action based on the belief that because a fund had done well in the past, it was guaranteed future success.

But it isn’t that simple. In fact, there are countless studies that show virtually no correlation between high performing funds in one period and high performing funds in future period.

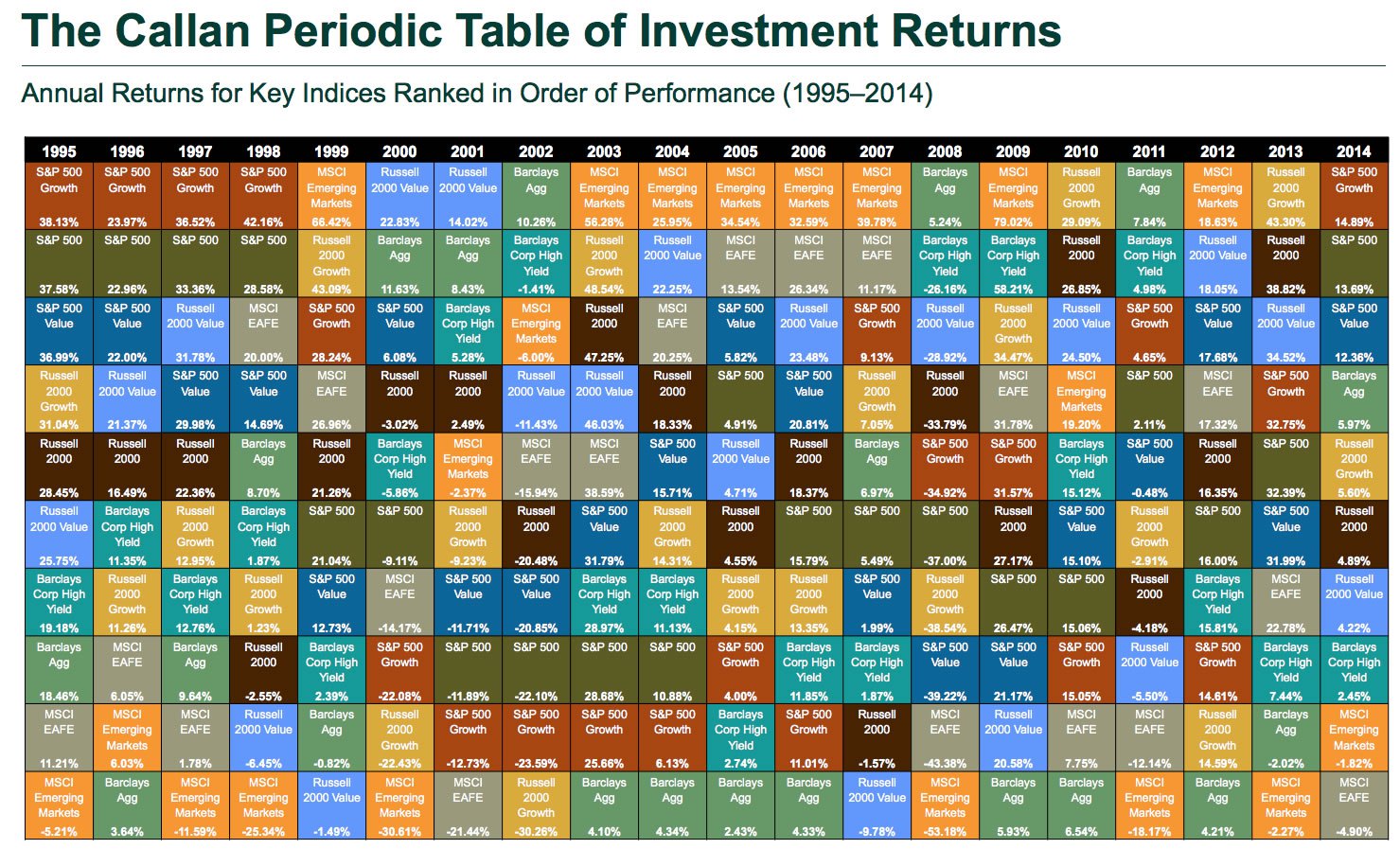

And unfortunately, as the Callan Periodic Table of Investment Returns depicts, mutual funds aren’t the only investment vehicle that suffers from inconsistent performance.

[Note: The Callan Periodic Table of Investment Returns graphically depicts annual returns for various asset classes, ranked from best to worst. Well-known, industry-standard market indices are used as proxies for each asset class.]

The Performance Paradox

The problem with performance chasing is that you are making moves based on what you wished would have happened. Most people wish they could have gotten in on the big gains bonds made between 1999 and 2002, but by the time they actually made the move, it was too late.

Chasing returns leads to what we call the performance paradox; the more you chase performance, the more likely you are to get farther and farther away from your intended result. The only way around this is to stop chasing performance. Stop confusing future expectations with past performance.

Just because an investment is popular today, just because it’s on the cover of magazine, or it’s what all your friends are investing in, doesn’t mean it right for you. Ignore the crowd and choose your investments because they are a good match for your objectives, risk tolerance and time horizon.