Most people know that they will eventually need to retire, but more than 40 percent of Americans have less than $10,000 saved. Those that are saving for retirement often earn below market returns. According to Delbar, the average mutual fund investor earned about half of the S&P 500’s total return.

There’s a lot of retirement advice covering how to remedy these problems by investing earlier, automating contributions, and investing in low-cost index funds. But few people know how much they should really be saving and how to make their existing retirement savings stretch further after retirement.

In this article, we will take a look at three investment strategies for retirement that go beyond the conventional advice to help you achieve your retirement goals.

Tax-Efficient Withdrawals

How and when you draw down various retirement accounts can impact your taxes in different ways.

Many experts recommend withdrawing no more than four percent of your retirement savings from taxable accounts during the first year. After that, you can increase the first year’s dollar amount annually by the inflation rate and move on to tax-deferred and Roth accounts after taxable accounts are stretched thin.

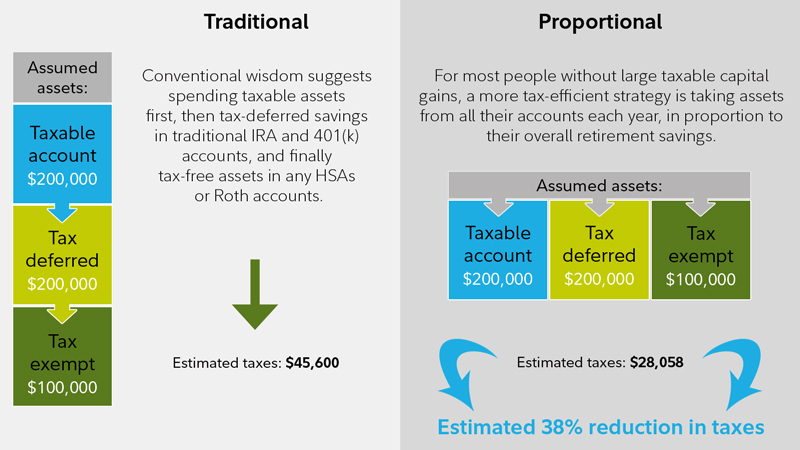

The problem with this approach is that it generates a lot of taxes early in retirement. Proportional withdrawals—or, taking out a dollar amount proportional to the percentage of total savings—may provide a more stable tax bill throughout retirement and potentially lower taxes over the course of your lifetime.

Comparing Withdrawal Strategies – Source: Fidelity

For example, Fidelity found that a proportional withdrawal strategy could cut taxes by almost 40 percent in some cases. These reductions could be even greater if spreading out taxable income lowers taxes paid on Social Security benefits or Medicare premiums, although the amounts depend on the individual.

You should also take capital gains when you’re in lower tax brackets. In particular, if you have taxable income that’s less than $38,600, you won’t owe any capital gains taxes, and it might make sense to use your taxable accounts first to meet expenses. After, you can use a proportional withdrawal strategy.

Focus on Goals, Not Returns

Most adults understand that they will eventually need to retire, but they aren’t necessarily doing much to prepare.

It’s important to establish retirement goals rather than focusing on maximizing returns. If you don’t set a goal, it’s impossible to determine how much to save, asset allocations, tax breakdowns, and probabilities of how much you can expect. You’re putting the proverbial chicken before the egg.

Here’s how to get started analyzing your goals:

- Lifestyle: Do you want a quiet retirement in your existing house or do you plan on traveling the world?

- Medical: Do you have any medical conditions that could increase the cost of retirement?

- Work: Do you plan on working a part-time job in retirement or do you want to avoid working at all?

- Children: Do you have children that you’d like to assist financially or provide for in a will?

Some of your expenses will typically disappear in retirement, such as mortgages or student loans. Other expenses will appear at various stages of life, such as medical expenses. You may also receive income from Social Security or pensions, as well as health coverage through Medicare or employer plans.

It’s important to determine how you want to spend your retirement, estimate your expenses, and calculate your projected income before trying to determine how much to save. Without taking these steps, you could be saving far too much or have unrealistic ideas for retirement in your head.

Once you’ve determined how much to save, you should create an automatic investment plan to achieve your goals. Automatic deductions should be taken out of your bank account each month and invested in low-cost funds with asset allocations designed to help you achieve your financial targets.

Generate Income with Options

Most people think of options as highly speculative. In fact, you have to apply for special permission from your brokerage to trade most types of options!

The reality is that options are only as speculative as you want—some strategies are actually very conservative. Unlike stocks, options can be used to achieve all kinds of goals, including speculation, hedging risk, and generating an income. Few investors realize that options can even be used in retirement.

Covered calls involve writing (selling) a call option that’s backed up by an existing stock position. For example, you may own 100 shares of Acme Co. and sell one call option that provides another investor the right to buy those shares at a higher price. In exchange, you receive the option premium.

If the stock price falls, you collect the option premium as income to offset some of the decline. If the stock price rises, you still keep the option premium, but you have to sell at the higher price (for a profit) or buyback the option. Either way, you gain an income that wouldn’t have been possible otherwise.

Snider Advisors specializes in helping retirement investors execute covered call strategies to maximize income during retirement. Using our proprietary stock analysis and automated trading software, The Snider Method help you generate income without making common mistakes.

If you’re interested in learning more, sign up for our free three part online income investment course.

The Bottom Line

There are a lot of opinions when it comes to retirement investing, but that doesn’t mean that you should settle on the status quo. Using the unique strategies that we covered, you can maximize your retirement income and ensure that you’re reaching your goals by going beyond the conventional advice.