Start with our 3-Part

Free Online Income Investment Course

An educated investor is a successful investor. We strongly believe in educating our clients to help them invest their own portfolio with our on-going support.

Educate Yourself with these FREE Investment Courses

Simple Strategies to Help You Rationally Evaluate Your Next Stock Purchase

Master the Fundamentals of Equity Options for Portfolio Income

Generate Income from Your Portfolio when Prices Decline

Guiding Principles of the Snider Method

1.

The bottom line is that no one cares more about your money than you do. Sure, it’s easy to point fingers, but it isn’t your broker, your CPA, the government, your parents, or even your spouse that is responsible for your current or future financial situation. It is you and you alone. Learn more

2.

The number that really matters is the actual spendable income, or cash flow, your portfolio can produce. Cash flow is the key to viability. Your portfolio must generate enough income to pace inflation, pay your taxes and support a reasonable standard of living. Learn more

3.

You will never be able to control the stock market. Market chaos and media frenzy will always exist – and your brain will always want to react. Until you are able to quiet the emotions that can so easily dictate your investments outcomes, you will never be a truly successful investor.

The best way to avoid paying the high cost of following your emotions is to stick to a rule-based system like the Snider Investment Method that addresses the human condition and allows you to manage your fear and greed.

4.

The problem is that investors tend to be myopic when it comes to risk. They worry about the inherent volatility of the stock market and think, “I just can’t bear the thought of losing money.” But market risk isn’t the only, or perhaps even the most significant, risk you face.

What would happen to you and your family if you lost your source of income and the safety net it provides? How do you hedge or insure against that risk? We believe you build an investment portfolio that generates a steady and consistent source of cash flow. The goal has to be to generate enough inflation-indexed income to replace your W-2 income at a moment’s notice.

5.

Unfortunately, too many people are peddling concepts as bad as (and oftentimes worse) than buy and hold. Among these is the idea of market timing. This concept of market timing is not only being hawked as a supposed cure for the buy and hold blues, but as a panacea for all investment woes.

Both logic and evidence tell us it’s impossible to time the market over long periods with any consistency. So why do so many financial advisors claim they can do the impossible, especially in light of the fact that the data proves trying to time the market actually does more harm than good?

The answer is simple and obvious. Salespeople have very different objectives than academicians. Academicians analyze facts in an effort to reveal the truth – and salespeople, well let’s just say that too many are less concerned with the truth than with their own financial bottom line.

There are only two reasons someone would try to convince you that you can make money by timing the market. They are either delusional and have convinced themselves they can do what no one else can – or they’re willing to sacrifice your security for their own greed. Admittedly, this is a strong statement, but the data doesn’t lie.

6.

However, the goal with investing in stocks is to fund long-term needs that may have less defined spending requirements, like retirement. Because you are focused on the long run, you cannot be overly concerned with short-term fluctuations in the market.

In the Snider Method, we screen for stocks from fundamentally sound companies that we would be willing to own for long periods of time, even if the price declines. Additionally, the Snider Method helps you manage your emotions, enabling you to keep short-term price fluctuations in perspective.

Emotionless Investing

The more emotional an event is, the less sensible people are.Dr. Daniel Kahneman, 2002 Nobel Prize Winner for Economics

Few things make us as emotional as the prospect of losing money. As humans, we are hardwired to seek out predators and react to warning signals. While this innate behavior may have helped keep our ancestors alive, it also makes it almost impossible to make good investment decisions. That’s why investing is a continual struggle between logic and emotion.

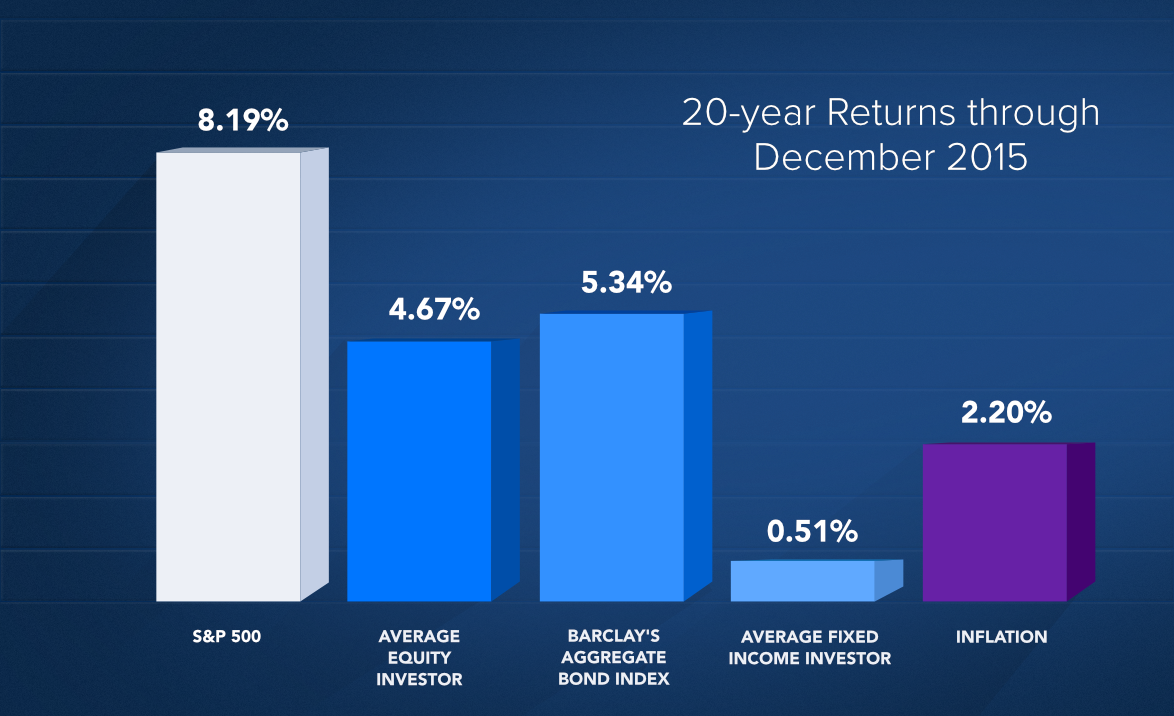

As you see depicted below, in the 20 year period ending in 2015, the S&P 500 had a return of 8.19%. However, the average investor only got 4.67%, underperforming their investment by a margin of more than 3.5%. It’s not just equity investors that fall behind. As you can see, fixed income investors trailed Barclay’s by an even greater distance.

Discipline is the best strategy for avoiding paying the high cost of following your emotions. Follow a rule-based system that is designed to address the human condition. The Snider Investment Method never relies on emotions or gut feelings to determine when to buy or sell. It works because it is a set of firm rules and steps, repeated deliberately and systematically month-to-month. Learn more about Managing Investor Emotions with our free online investment course.